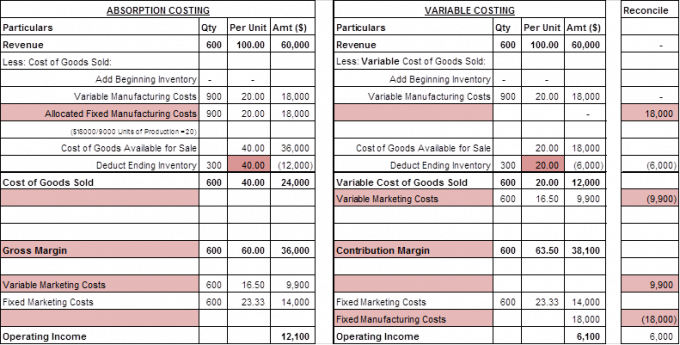

These costs are hidden in inventory and don’t appear on the income statement when assigning these fixed costs to the cost of production, as absorption costing does. Because Nepal does not carry inventory, the income is the same under absorption and variable costing. Carefully study the arrows that show how amounts appearing in the absorption costing approach would be repositioned in the variable costing income statement. Since the bottom line is the same under each approach, this may seem like much to do about nothing. But, remember that “gross profit” is not the same thing as “contribution margin,” and decision logic is often driven by consideration of contribution effects.

Absorption Costing vs. Variable Costing Example

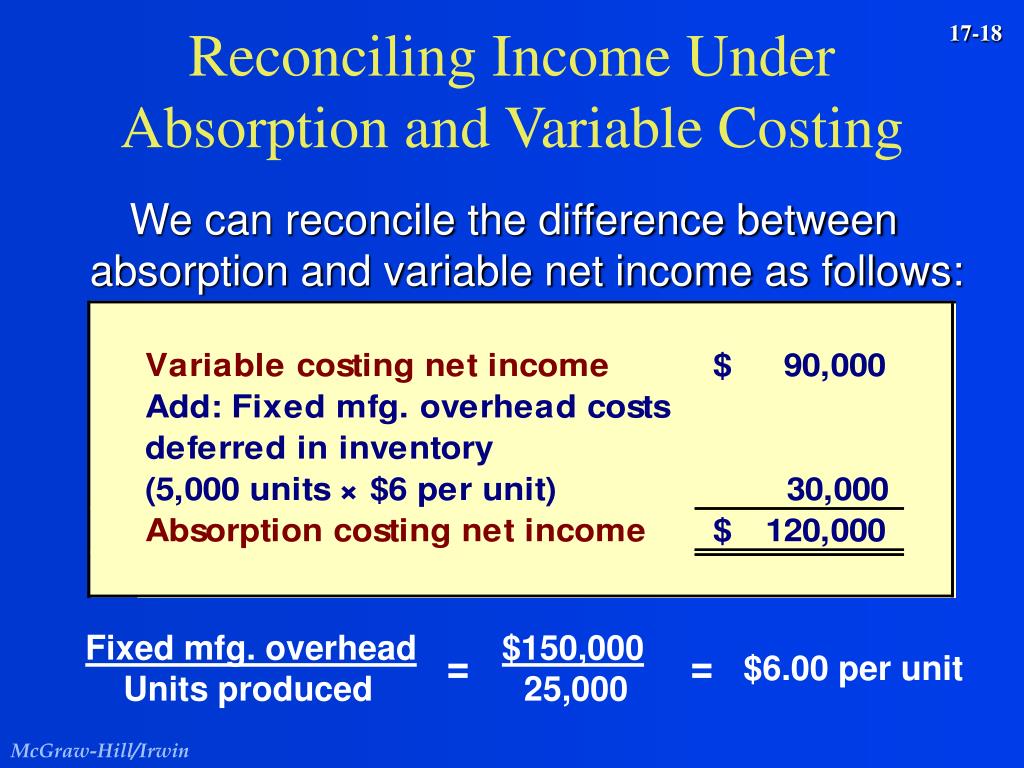

While this was not the only reason for manufacturing too many cars, it kept the period costs hidden among the manufacturing costs. Using variable costing would have kept the costs separate and led to different decisions. Under absorption costing, each unit in ending inventory carries $0.60 of fixed overhead cost as part of product cost. Therefore, ending inventory under absorption costing includes $600 of fixed manufacturing overhead costs ($0.60 X 1,000 units) and is valued at $600 more than under variable costing. Under absorption costing, the fixed manufacturing overhead costs are included in the cost of a product as an indirect cost. These costs are not directly traceable to a specific product but are incurred in the process of manufacturing the product.

How is absorption costing treated under GAAP?

Fixed manufacturing costs are regarded as period expenses along with SG&A costs. The short answer is that the fixed manufacturing overhead is going to be incurred no matter how much is produced. But, on a case-by-case basis, including fixed manufacturing overhead in a product cost analysis can result in some very wrong decisions. Finally, remember that the difference between the absorption costing and variable costing methods is solely in the treatment of fixed manufacturing overhead costs and income statement presentation. Regarding selling and administrative expenses, the only difference is their placement on the income statement and the segregation of variable and fixed selling and administrative expenses. Variable selling and administrative expenses are not part of product cost under either method.

Determining product vs. period costs

It may see an increase in gross profit after paying off the mortgage or finishing the depreciation schedule on a piece of manufacturing equipment. These are considerations that cost accountants must closely manage when using absorption costing. Absorption costing is not as well understood as variable costing because of its financial statement limitations.

Advantages and Disadvantages of the Variable Costing Method

- Absorption costing allocates these costs to units of production, regardless of whether they are sold or remain in inventory.

- Since the fixed cost does not change with variation in the production units, it is not considered a direct contributor to the cost of production.

- These costs are subtracted from sales to produce the variable manufacturing margin.

- Recording depreciation in the period in which it is incurred ensures that the financial statements reflect the true economic position of the business.

The absorption cost per unit is the variable cost (\(\$22\)) plus the per-unit cost of \(\$7\) (\(\$49,000/7,000\) units) for the fixed overhead, for a total of \(\$29\). In contrast, variable costing treats fixed manufacturing overhead as a period cost. This means that fixed overhead is expensed in the period in which it is incurred, rather than allocating it to inventory. It may be beneficial to use the variable costing method depending on a company’s business model and reporting requirements or at least calculate it in dashboard reporting. Managers should be aware that both absorption costing and variable costing are options when reviewing their company’s COGS cost accounting process. Using the absorption costing method will increase COGS and thus decrease gross profit per unit produced so companies will have a higher breakeven price on production per unit.

Many companies use both methods, depending on the type of product being produced and the nature of the company’s operations. For example, a company manufacturing products with high indirect costs would likely use absorption costing. In contrast, a company that sells many different products might use direct costing. Under absorption costing, direct materials, direct labor, and overhead are all included in the cost of a product. In addition, the use of absorption costing generates a situation in which simply manufacturing more items that go unsold by the end of the period will increase net income.

In the previous example, the fixed overhead cost per unit is $1.20 based on an activity of 10,000 units. If the company estimated 12,000 units, the fixed overhead cost per unit would decrease to $1 per unit. Variable costing, also known as direct costing, only includes variable production costs in determining the cost of a product. Fixed overhead costs are treated as period costs and expensed in the period incurred rather than allocated to units produced. In contrast, absorption costing, also known as full costing, allocates a share of both variable and fixed manufacturing costs to each unit produced. Because absorption costing includes fixed overhead costs in the cost of its products, it is unfavorable compared with variable costing when management is making internal incremental pricing decisions.

The total of direct material, direct labor, and variable overhead is \(\$5\) per unit with an additional \(\$1\) in variable sales cost paid when the units are sold. Additionally, fixed overhead is \(\$15,000\) per year, and fixed sales and administrative expenses are \($21,000\) per year. While companies use absorption costing for their financial statements, many also use variable costing for decision-making. The how to view previous turbo tax files Big Three auto companies made decisions based on absorption costing, and the result was the manufacturing of more vehicles than the market demanded. With absorption costing, the fixed overhead costs, such as marketing, were allocated to inventory, and the larger the inventory, the lower was the unit cost of that overhead. For example, if a fixed cost of $1,000 is allocated to 500 units, the cost is $2 per unit.

If you look back at the example of absorption cost, you will see that the per-unit cost of production is reduced as units are increased. Based on absorption costing methods, the additional unit appears to produce a loss of $0.50, and it appears that the correct decision is to not make the sale. Variable costing suggests a profit of $0.50, and the information appears to support a decision to make the sale.