One limitation of break-even analysis is that it assumes selling prices will stay the same over time. In reality, prices often fluctuate due to market conditions, competition, or changes in demand. For example, if you run a café, you might decide to lower the price of your best-selling drink to attract more customers. While this could boost foot traffic, it also means your break-even point will change and you’ll need to sell more drinks to reach profitability. Break-even analysis can help determine those answers before you make any big decisions. For example, if the demand for your product is smaller than the number of units you’ll need to sell to breakeven, it may not be worth bringing the product to market at all.

Do you own a business?

Depending on your needs, you may need to calculate your profit margin or markup to find your revenue… This will allow you to calculate the maximum price you may pay for goods, given all of your other numbers. You can also check out our markup calculator and margin calculator.

Increase product prices

Consider the following example in which an investor pays a $10 premium for a stock call option, and the strike price is $100. The breakeven point would equal the $10 premium plus the $100 strike how twitter and facebook think they handled the election price, or $110. On the other hand, if this were applied to a put option, the breakeven point would be calculated as the $100 strike price minus the $10 premium paid, amounting to $90.

Why Should Taxes and Fees Be Included in a Break-Even Analysis?

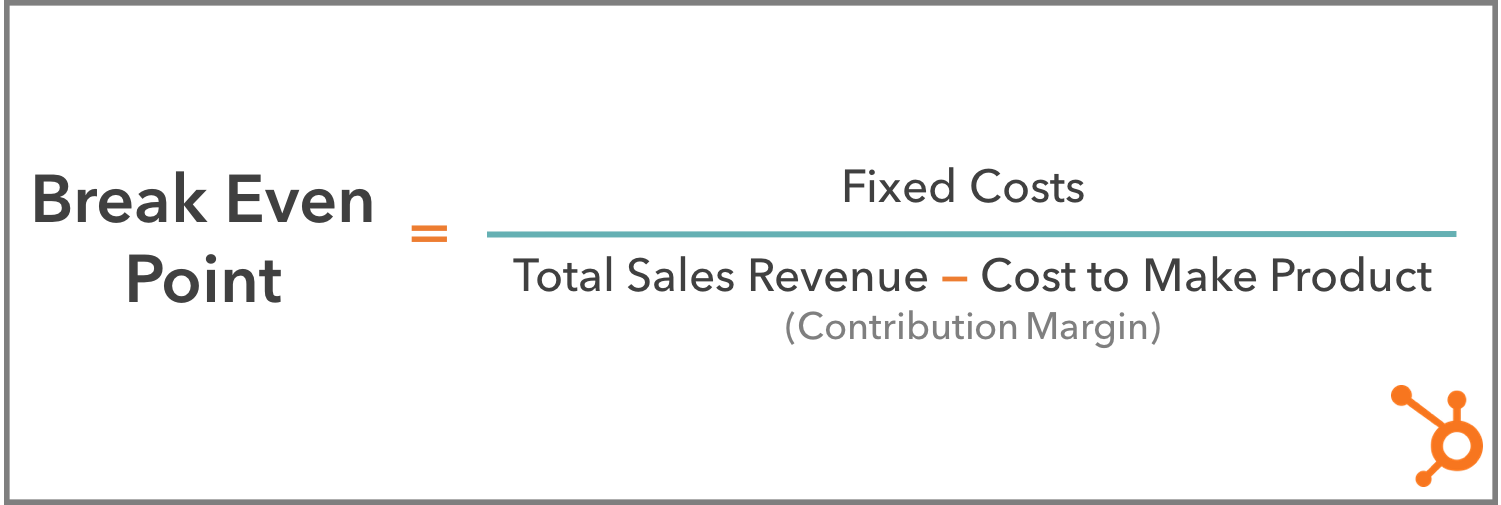

The break-even point is the point at which there is no profit or loss. When companies calculate the BEP, they identify the amount of sales required to cover all fixed costs before profit generation can begin. The break-even point formula can determine the BEP in product units or sales dollars. The breakeven formula for a business provides a dollar figure that is needed to break even. This can be converted into units by calculating the contribution margin (unit sale price less variable costs).

It is only useful for determining whether a company is making a profit or not at a given point in time. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Here, the calculation is simpler because the maturities are the same. Then, divide the traditional bond’s number by the inflation-indexed bond’s number and subtract one from the result. The other typical situation involves comparing a traditional bond with a bond with the same maturity date whose principal value automatically adjusts for inflation. In this case, you’re calculating the break-even interest rate of inflation for which buying the inflation-indexed bond will provide a larger return.

Where Should We Send Your Answer?

- Break-even analysis looks at internal costs and revenues, but doesn’t factor in external influences that can impact your business.

- If you find yourself asking these questions, it’s time to perform break-even analysis.

- Break-even analysis works well for short-term planning, like setting immediate sales goals or dedication to prices.

- This will allow you to calculate the maximum price you may pay for goods, given all of your other numbers.

- One common situation involves deciding the maturity of the bond you want to buy.

Presently the annual sales are $100,000 but the sales need to be $299,520 per year in order for the annual profit to be $62,400. An example would be a salesperson’s compensation that is composed of a salary portion (fixed expense) and a commission portion (variable expense). The variable portion can be listed with other variable expenses and the fixed portion can be included with the other fixed expenses. Check out our piece on the best bookkeeping software for small-business owners. At the break-even point, you’ve made no profit, but you also haven’t incurred any losses. This metric is important for new businesses to determine if their ideas are viable, as well as for seasoned businesses to identify operational weaknesses.

Assume an investor pays a $4 premium for a Meta (formerly Facebook) put option with a $180 strike price. That allows the put buyer to sell 100 shares of Meta stock (META) at $180 per share until the option’s expiration date. The put position’s breakeven price is $180 minus the $4 premium, or $176. If the stock is trading above that price, then the benefit of the option has not exceeded its cost. If the stock is trading at $190 per share, the call owner buys Apple at $170 and sells the securities at the $190 market price. The profit is $190 minus the $175 breakeven price, or $15 per share.

Break-even analysis is an important way to help calculate the risks involved in your endeavor and determine whether they’re worthwhile before you invest in the process. When analyzing your break-even point, not only do you want to see that your business is breaking even, you’re looking to make sure your business is profitable as well. Here are a few ways to lower your break-even point and increase your profit margin. Once you’ve decided whether you want to find your break-even point in sales dollars or units, you can then begin your analysis. Fixed costs are any non-fluctuating costs that you pay on a regular basis, such as monthly or yearly. These are the same regardless of how many items you sell and include things like rent and business insurance.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The break-even point or cost-volume-profit relationship can also be examined using graphs.

However, after establishing market dominance, a business may begin to raise prices when weak competitors can no longer undermine its higher-pricing efforts. Break-even price is also used in managerial economics to determine the costs of scaling a product’s manufacturing capabilities. Typically, an increase in product manufacturing volumes translates to a decrease in break-even prices because costs are spread over more product quantity.

The main thing to understand in managerial accounting is the difference between revenues and profits. Since the expenses are greater than the revenues, these products great a loss—not a profit. To find the total units required to break even, divide the total fixed costs by the unit contribution margin. Break-even analysis involves a calculation of the break-even point (BEP). The break-even point formula divides the total fixed production costs by the price per individual unit less the variable cost per unit.